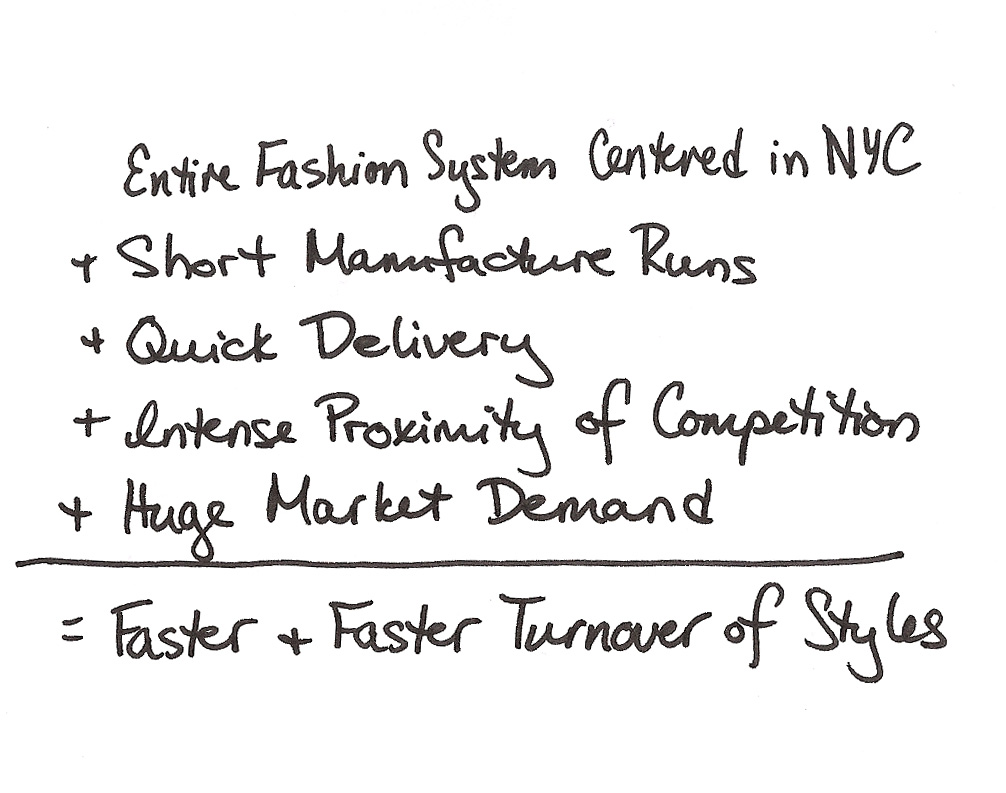

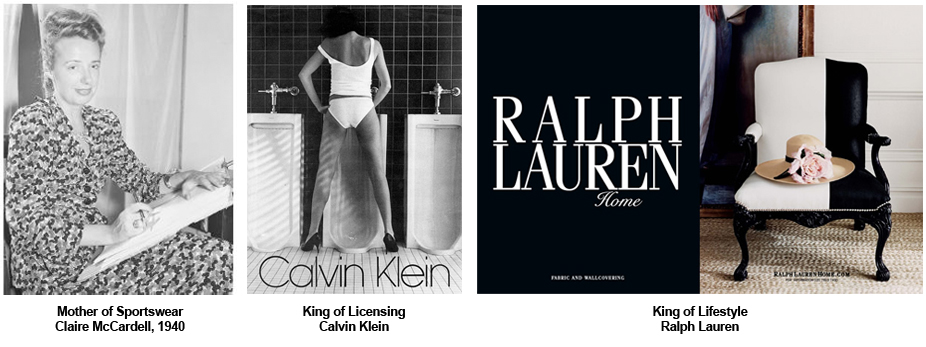

The American model for the fashion business began with sportswear, moved through licensing giants, and now includes the behemoth category "total living."

Roots in Sportswear

Claire McCardell was probably the most influential American designer to be associated with New York design through her simple collections of sportswear, adhering to a basic and unchanging set of stylistic and practical criteria. Beginning her collections in 1940 to her death in 1958, her designs stood as the antithesis to the Parisian New Look.

Other prominent sportswear designers to emerge around or after WW2 included Charles James (who was commercially unsuccessful in ready-to-wear, and later returned to couture), Mainbocher (who relocated from Paris to NY with a clean aesthetic style), and later Bill Blass, Betsey Johnson and Scaasi (a native Canadian who drew great inspiration from the NY lifestyle and culture).

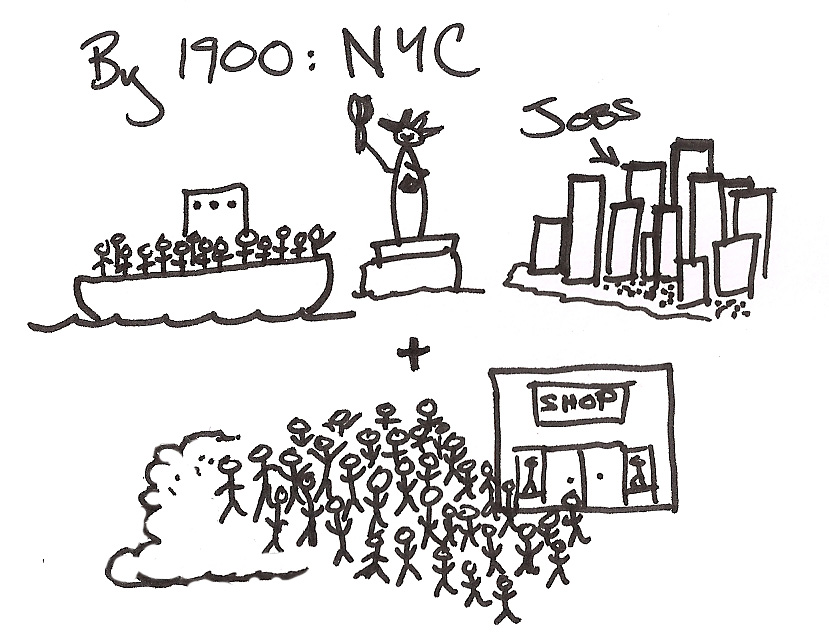

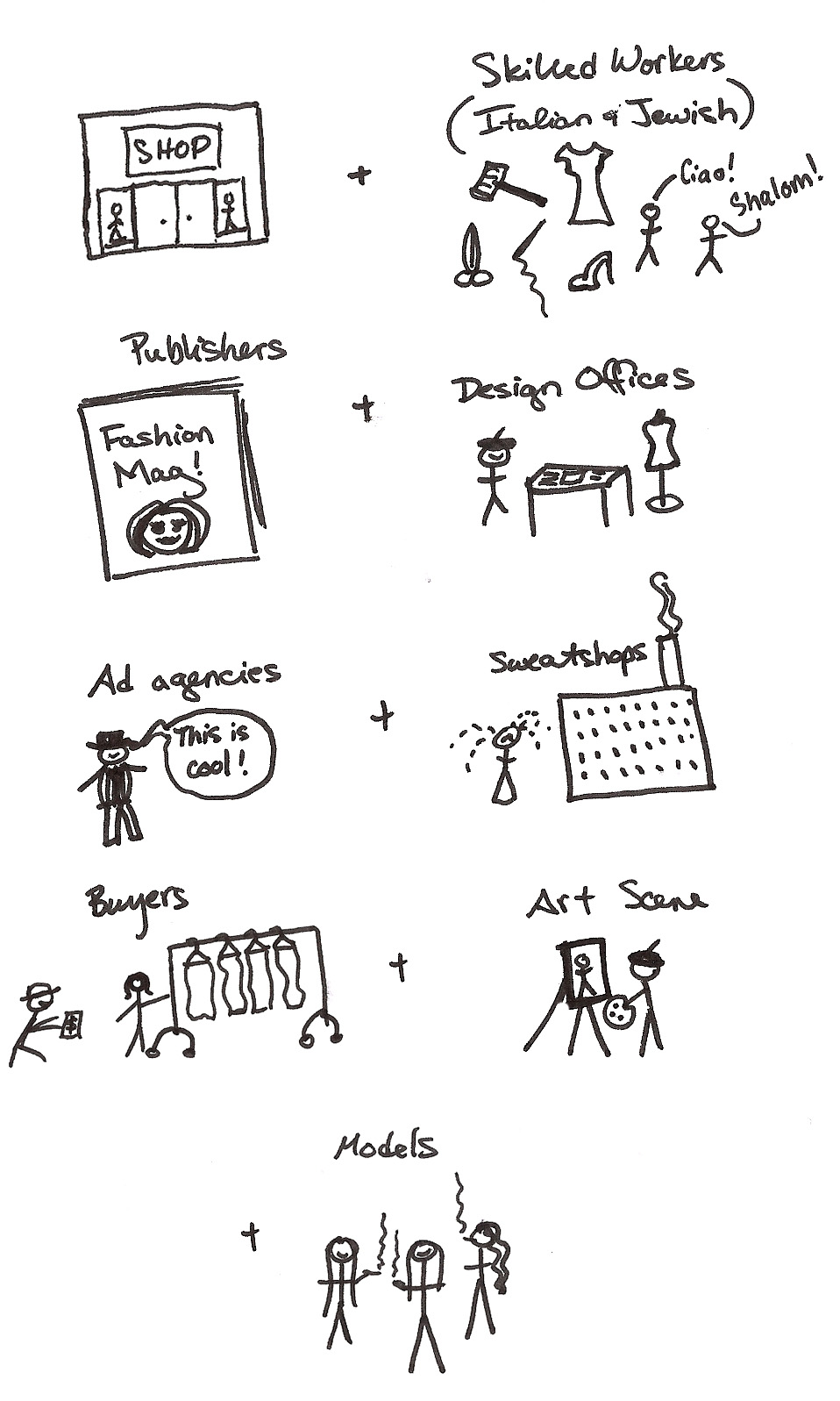

While the Parisian couture movement after the war was aimed at recreating a national high art, NY couturiers were much more open and exposed to influences in commerce and pop culture. Many creative forms were evolving through the work of Pollock, Rothko, Warhol, Oldenburg and others, and American fashion designers' receptiveness to these creative changes sustained their relevance. Furthermore, the ethnic/cultural melting pot of NYC called for a basic aesthetic that would suite everyone, leading to the American style of simplicity through clean lines, colors and patterns.

Casual, easy-to-wear (and maintain) items originally developed by McCardell paved the way for subsequent designers to rework the new classics, based on the cultural movements of the day. Think: Halston, Geoffrey Beene, Perry Ellis, and later Calvin KleinDonna Karan. and

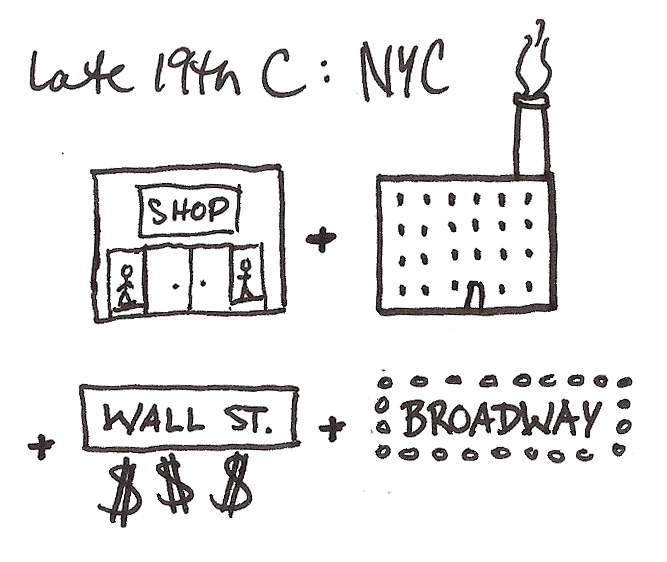

Brands & American Culture

Basics = Glamor

American brands grew famous not only through ease-of-use, but by applying glamor to the basics. Calvin Klein was really the first to bring this strategy onto the international stage with cK Jeans.

Sex Sports Sells

American brands maintained a wholesome edge by applying sport motifs to marketing campaigns. Ralph Lauren is really the champion here (ha, champion), naming lines in his arsenal after waspy sports (polo, rugby, etc.).

No Logo???

American companies were first to mark-up and sell basics by brand name. While this began in the US, it is now a global trend. I'm looking at you, GAP.

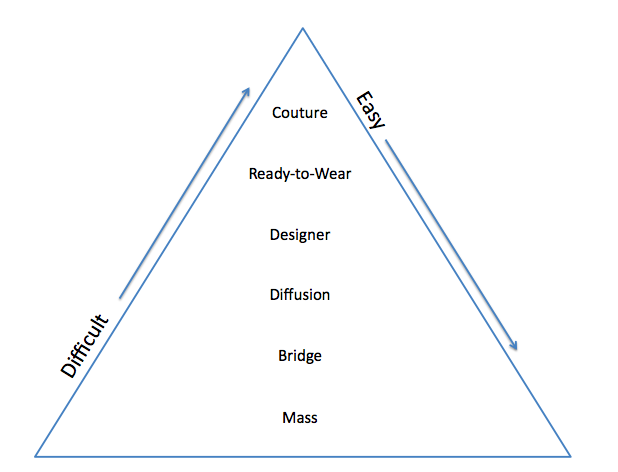

The Challenge of Democratic Fashion

American designers have a tradition of taking inspiration from the streets and pop culture. A brand image based on a lifestyle within pop culture makes US brands highly appealing in the mass market, and allows for an easy shift from product specialization (dresses) through licensing of additional products (underwear, sunglasses, perfume) to a total-living product range (clothes, accessories, furniture, house paint). However, it also presents some limitations outside of the US market, namely in Europe.

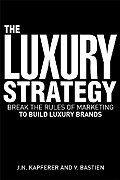

There exists a problem of perception of US brands, making it difficult for them to gain market share in Europe.

If a consumer thinks a country's production system is geared towards the mass market, she will have problems associating that country's products with high-end, exclusive quality. This perception is furthered when a brand enters a foreign market at the lowest price point.

Most high-end designers enter the market at the top level, and then trickle-down into the mass market. (Even Armani, who just added a couture line in 2006, began in high-end ready-to-wear.)

cK and some other US brands have entered the EU market at the most accessible lower levels (underwear), and then have problems moving into the upper end. Once you position yourself at the bottom of the market, it is very difficult to move up against market perception. It would be similar to the GAP opening a couture line in the eyes of the European market.

Change is Gonna Come

Against this perception is the current economic crisis, which is leveling the playing field in production quality as European brands are increasingly forced to outsource into developing countries, making the "Made in the USA" mark gain relative global superiority. Also, younger American designers are becoming increasingly coveted around the world (Marc Jacobs, Vera Wang, Thakoon, Philip Lim, Jason Wu, etc) by demonstrating modern global aesthetic relevance in combination with the US style that is down-to-earth and easy.

As the classic European brands look to shake the dust off by employing entertaining head-designers and pumping millions into blowout marketing campaigns, the American brands maintain relevancy by willingly passing the generational torch to young designers (bringing youthful vigor to the whole industry); paying attention to and anticipating market shifts; and by sticking to the tradition of ease and multi-cultural simplicity.